- MOTIVEWAVE ELLIOTT WAVE WITH FIB RATIOS TUTORIAL MAC OSX

- MOTIVEWAVE ELLIOTT WAVE WITH FIB RATIOS TUTORIAL SOFTWARE

- MOTIVEWAVE ELLIOTT WAVE WITH FIB RATIOS TUTORIAL PROFESSIONAL

Whether you’re an analyst or a trader, MotiveWave has a product for you, with lease or own options to fit every budget. MotiveWave is broker and data feed neutral, and we support Windows, macOS and Linux.

MOTIVEWAVE ELLIOTT WAVE WITH FIB RATIOS TUTORIAL SOFTWARE

We also have the most advanced Elliott Wave software available.

MOTIVEWAVE ELLIOTT WAVE WITH FIB RATIOS TUTORIAL MAC OSX

MotiveWave is available for Microsoft Windows and Mac OSX platforms. MotiveWave is a feature-rich, user-friendly, highly customizable trading software with beautiful charts. Motivewave Software prides itself in offering traders both the necessary analysis tools, such as Ratio, Fibonacci, Radio Wave, Gann and Gartley Analysis and the features that you would normally benefit from on a standalone trading platform: custom strategies and strategy trading, walk-forward testing, backtesting, reporting, replay mode, and.

This allows you to trade forex, futures, stocks, CFDs, options, whatever the broker supports. You can choose the broker that best meets your needs in terms of reliability, trade execution and commission rates while using best of breed trading and analysis tools.

MOTIVEWAVE ELLIOTT WAVE WITH FIB RATIOS TUTORIAL PROFESSIONAL

Plus, MotiveWave has all of the features (and more) that you would expect in a professional trading platform.īy integrating with your existing broker, MotiveWave lets you have the best of both worlds. Nick Radge, Head of Research and Trading at The Chartist ran this webinar for subscribers outlining the rules and guidelines for Elliott Wave Analysis.The Chartist.

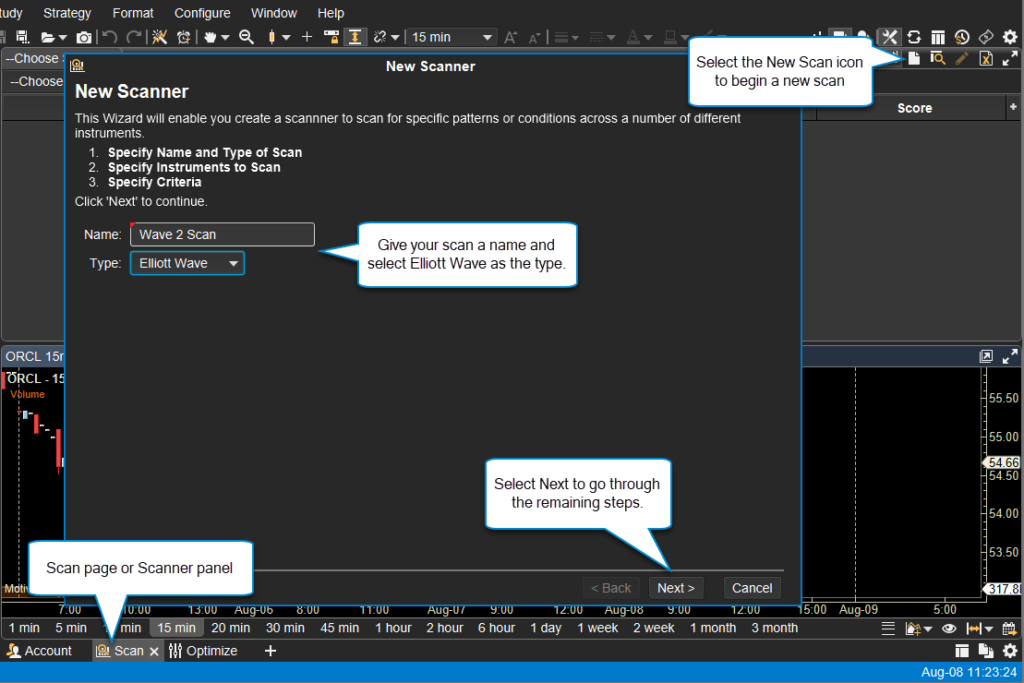

This is because we never know for sure how far the market will retrace and we don’t want to miss the move. Our Elliott Wave entry points are at 38.2. For example, in impulse wave: Wave 2 is typically 50, 61.8, 76.4, or 85. One of the Elliott wave rules states that, ideally, wave 4 should retrace between 38.2 and 50 Fibonacci retracement of wave 3. Different waves in an Elliott Wave structure relates to one another with Fibonacci Ratio. Fibonacci Ratio is useful to measure the target of a wave’s move within an Elliott Wave structure. A few segments inside the XLI have the potential to become new market leaders, though the broad XLI itself remains in the Improving Quadrant. 2.5 Relation Between Fibonacci and Elliott Wave Theory. MotiveWave has very advanced charts and drawing tools that are highly customizable and yet still easy-to-use. TechnicalStock Analysis Using Elliott Wave and Fibonacci. MotiveWave is an easy-to-use charting, analysis and trading platform, built for the individual trader, which also specializes in advanced analysis tools like Elliott Wave, Fibonacci, Gartley, Gann and Ratio Analysis. MotiveWave’s trading software is designed to make trading and market analysis easier and faster.

0 kommentar(er)

0 kommentar(er)